The last thing you want to think about when you are managing relationship breakdown is tax documents. Gathering financial disclosure can be tedious and time consuming at the best of times, and these are NOT the best of times, so it is tempting to set this task aside for another day. Besides, are these documents even necessary? (Spoiler alert: yes)

In this article, we review the following:

- What is an “income tax return” and a “notice of assessment”?

- What information is used from these documents?

- Why is it important to provide this information immediately?

- What about privacy concerns?

What is a “personal income tax return” and what is a “notice of assessment”?

First, back to basics. Your family lawyer is likely to ask you for “personal income tax returns” and “notices of assessment” for the most recent three-year period (at the time of writing, this means 2019, 2020, and 2021):

-

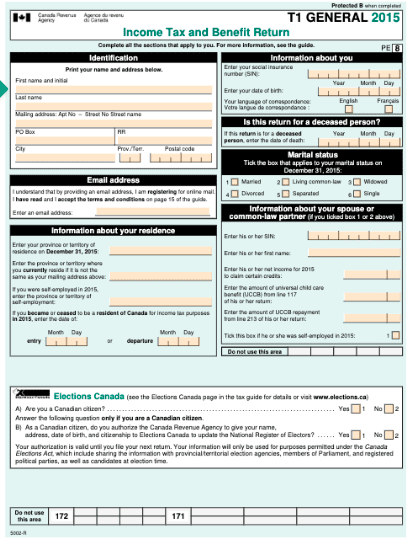

- Your “personal income tax return” or T1 is the form you complete when you are filing your taxes. The first page looks like this:

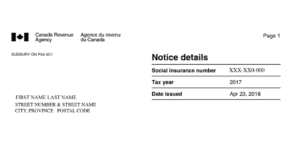

- Your “notice of assessment” is the document provided to you by the Canada Revenue Agency (CRA) after your taxes are filed. This document can also be found on your CRA MyAccount. The first page looks like this:

- Your “personal income tax return” or T1 is the form you complete when you are filing your taxes. The first page looks like this:

Family lawyers ask for a three-year period in part because this is specified in the legislation (see for example Rule 13(3.1)(1) of the Family Law Rules, section 21(1) and (2) of the Federal Child Support Guidelines, and section 21(1) and (2) of the Ontario Child Support Guidelines. A three-year period also gives a good sense of your pattern of income (that is, does your income go up and down, does it steadily increase, etc.), which allows your family lawyer to better advise you on the issues of spousal and child support.

What information is used for my family law case?

Your tax documents are primarily used to understand the type and amount of income you are earning for the purposes of determining child and spousal support issues. The following is a non-exhaustive list of line items on your tax documents with which you should be familiar:

- Line 10100: this is your employment income if you are a T4 employee.

- Line 10400: this is for any income you earned from tips or gratuities, or casual income that does not appear on a T4.

- Line 11500: if you received a T4A for your pension income, this amount is entered here.

- Line 12600: if you receive rental income, the net amount is entered here.

- Line 12000: if you receive dividend income from a Canadian corporation, this will be entered here.

- Line 15000: this is your total income before deductions (your “net income”) and includes the information from the line items above (and others).

Understanding where your income comes from (employment income, taxable dividends) is important as the type of income you earn affects how spousal and child support are calculated. That is, it is not enough to forward your lawyer your line 15000 income amount and call it a day.

Why is it important to provide my tax disclosure immediately?

Tedious though it may be, disclosure of your income is a key part of settling your family law matter and the faster you provide tax documents to your lawyer, the faster they can advise you on issues such as spousal support and child support. If your matter is proceeding to mediation, income disclosure will assist the mediator in helping you and your ex-partner come to a reasonable settlement. And if your matter is proceeding to court and involves a support claim of any kind, certain tax documents are required in order to provide your other materials to the court (see for example Rule 13(3.1)(1) of the Family Law Rules).

While we are on the subject of court proceedings, in a recent Notice to the Profession, Chief Justice Morawetz confirmed the following concerning financial disclosure:

Family litigants are expected to exchange full and frank financial disclosure as early as possible in the case to avoid unnecessary delay and expense. It is the Court’s expectation that all reasonable efforts will be made to provide this disclosure to the other party in advance of the case conference.

If disclosure cannot be resolved despite these efforts, the party seeking that disclosure must include in their materials a list of the outstanding disclosure in accordance with Rule 13(11.01).

Costs may be awarded pursuant to Rules 17(18) or 24(7) where a party has failed to comply with their disclosure obligations in accordance with the applicable legislation or the Family Law Rules (emphasis added).

Ok, so I definitely need to provide the tax documents. But I’m concerned about my privacy. What can I do?

Tax documents are “Protected B” documents, which means they contain sensitive information, most notably your social insurance number, which if compromised may cause serious trouble for you. This information should be redacted per Rule 1.2(1) of the Family Law Rules:

After serving but before filing a document under these rules, including a financial statement (Form 13 or 13.1) or net family property statement (Form 13B or 13C), the party filing the document shall redact or omit from it and from any documents attached to it all identifying financial account numbers and personal identification numbers (emphasis added).

A complete and un-redacted copy of your tax documents must still be available and provided to a judge on request per Rule 1.2(3), but redaction ensures limited exposure to your social insurance number.

If you have more questions about financial disclosure, please contact one of the family litigation lawyers at Richardson Hall LLP to see how we can help.

*This article is not intended to provide legal advice.